-

Posts

3,580 -

Joined

Content Type

Profiles

Forums

Events

Blogs

Gallery

Everything posted by Woodstock Jag

-

Ricco Diack scores v Airdrie 20.04.2024

Woodstock Jag replied to Camallain's topic in Main Jags forum

Real composure there. Wouldn't have wanted to be him if he missed and had Brian Graham screaming in his face for not squaring it for his hat-trick mind! -

Partick Thistle 🔴🟡 Vs The Vile Diamond ♦️♦️

Woodstock Jag replied to jagfox's topic in Main Jags forum

Statistical pedants are the vital core of our support. -

Gross league prize-money difference is about £100k between 1st and 2nd, then £90k for each place between 2nd and 5th, then £30k between 5th and 6th, then £15k per place between 6th and 10th. The net impact on the budget for each place is smaller (for example you need to take into account the footballing department’s bonus structure) but the fundamentals of the numbers haven’t shifted very much for many seasons now. The team finishing bottom of the Premiership get roughly double the pot that the Championship winners get.

-

That's us mathematically guaranteed at least 5th, as Dunfermline and Ayr play each other final day (so only one of them can overhaul the 9 point gap). But a bit nervous now with Airdrie. Playing each other, both still to play the league winners, and then they have Queen's Park while we have Ayr. Probably their run-in marginally easier. Big game Saturday. Finishing 3rd instead of 4th is really handy financially.

-

Not for long...

-

I think the point is that if we'd won the game instead of drawn it, we'd have finished above both Ayr and Queen's Park.

-

Apart from today and last weekend, when if at all have the surnames of the Thistle goalkeeper and the entire back line all begun with the same letter (Mitchell, McMillan, Muirhead, McBeth, Milne)? What’s the highest number of Thistle players with the same first letter of surname to have been on the park at the same time? And what was the narrowest alphabetical spread of any Thistle starting XI (eg today’s was F(itzpatrick) to R(obinson) but had an astonishing 8 players across consecutive letters LMN)?

-

-

Only two teams have ever finished second bottom in the second tier of Scottish football on more than 39 points. We are already on 40 points. Bad as the last few weeks have been, we really would be setting new trends to be a relegation risk this year.

-

Raith rovers game bring friend for £10

Woodstock Jag replied to Third Lanark's topic in Main Jags forum

That was genuinely painful viewing from start to finish. This run is grim. -

Hampden is a terrible place to watch a second tier football match. G4S are a consistently rubbish organisation.

-

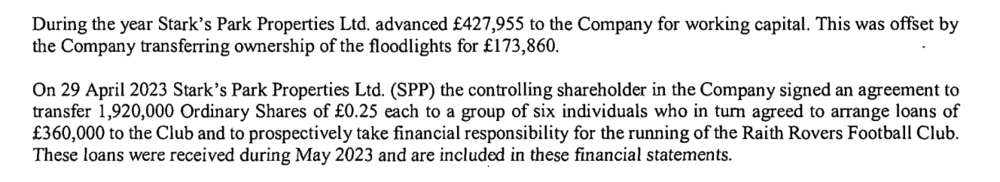

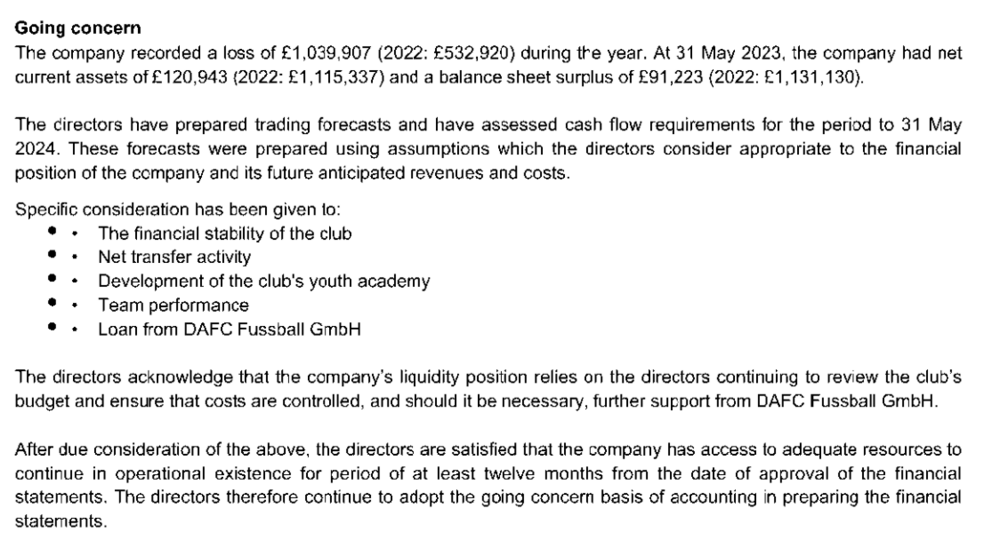

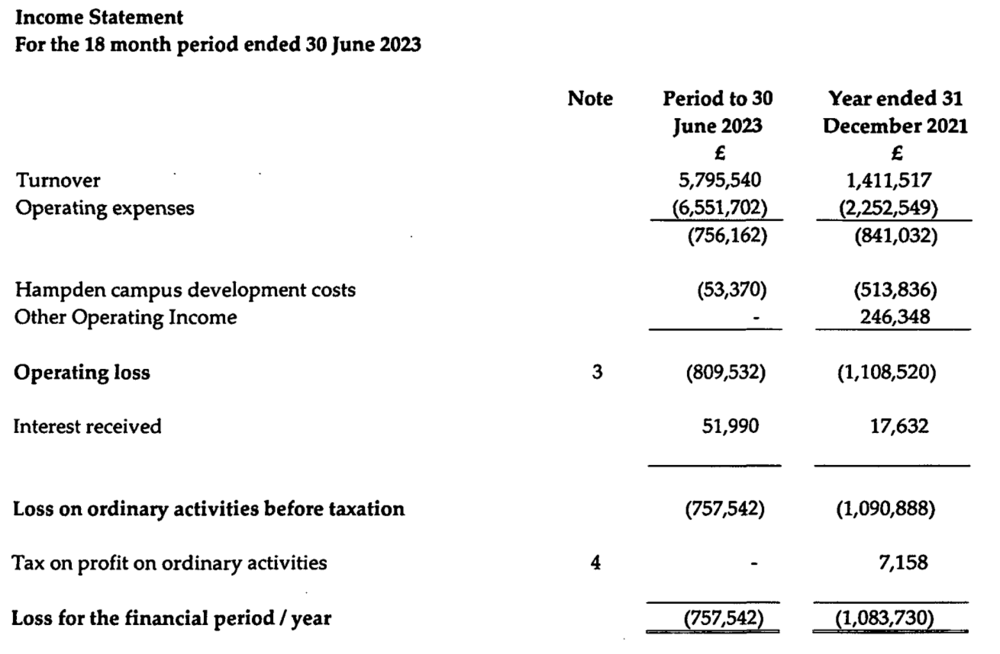

Raith Rovers: living off advances for working capital, directors' loans and even selling off their floodlights Dunfermline: £1 million loss and a tricky going concern statement Queens' Park: lost £750k over an 18 month (extended) accounting period, despite this (mostly) not involving the lion's share of the Lesser Hampden redevelopment costs. Being propped-up by, among other things, the multi-million cash proceeds accrued from selling Proper Hampden.

-

Neilson ultimately to blame for the goal by failing to clear, but he looks much more comfortable in the defensive mid berth than at left centre back. Think we also learned today that it’s more important for Wasiri to be at right centre back than for Muirhead to be. Scott Robinson was decent too. Folk were worried that with this line up we’d be overrun in midfield but it was anything but. Tired a bit late on but much optimism. Also Dundee United are an incredibly dirty team.

-

Brian Graham scores v Dundee United 02.03.2024

Woodstock Jag replied to Camallain's topic in Main Jags forum

Wasiri deserves that one! -

I hear Douglas Noble once said that Earth's atmosphere contains oxygen, so I'm now roaming Alexandria wearing diving apparatus.

-

Gerry Britton was also there as Chief Executive. Are you suggesting that he and Smillie fraudulently misrepresented the decisions of the Club Board to its incoming directors? Are you absolutely sure this is the road you want to go down, Jim?

-

Taking a screenshot of this for posterity!

-

That's a judgment call for the Club Board. Personally, I would not (speaking purely as a fan) support the dismissal of Doolan if we narrowly missed out on the play-offs this season. He's a young manager and deserves time and resources to get it right. I have less patience for a manager who failed to salvage our place in the Championship when brought in in 2019, had more than a full season to establish his preferred squad, and had us losing to part-time football teams and losing momentum. Is the loss of momentum in recent games concerning? Absolutely. Are Doolan's and McCall's positions remotely comparable? Absolutely not.

-

Yes you are. Here's the direct quote in the Club statement, in full: You're just making stuff up. I keep receipts, Jim.

-

They typically have a very modest impact (less than the impact of, for example, finishing 2nd instead of 3rd) because a significant proportion of ticket revenue goes directly to the SPFL and most Clubs' bonus structures pay out more to players depending on performances in the play-offs themselves.

-

Utter nonsense. The footballing justification given for relieving McCall of his duties was that a change of manager was more likely to secure promotion. The concerns about the likelihood of having a chance to achieve this were heightened by McCall overseeing the Club fall out of the play-off places, which would leave it completely ineligible for promotion at the end of the season. Doolan was hired to improve the league position and did so, securing a play-off spot. He failed to win promotion, but no one said that was the condition of his employment. At the moment, Kris Doolan's side is in the play-offs, which meets the target set by the current board, and actually exceeds the position on which budgeting assumptions are now made at the Club. So you're wrong about literally everything.

-

I'll stop you right there. At absolutely no point did the New Board state, or even imply that the target was "Promotion Outright by Winning the League". They said that the target was promotion. Not to win the league outright. So you're just talking rubbish.

-

Correct.

-

For the most part, they run losses underwritten by soft loans, other forms of debt, or regular investment from benefactors. Dundee lost over £800k in 2021-22 and posted substantial six-figure losses last season too. Dundee United have consistently posted seven figure losses in recent seasons. Raith Rovers saw heavy reliance on benefactors in recent seasons, and only made profits when on good cup runs. Their new investors say they have drastically improved their position. We shall have to wait and see if this is off the back of a decent league campaign or something more. Morton lost six figure sums in both of the last two seasons despite big Old Firm Cup ties away from home. Queen's Park are burning through the multi-million proceeds of selling the national stadium. Ayr United have been underwritten by various benefactors in recent seasons. Inverness lost over £800k last year and is relying on land redevelopment projects to remain viable. Dunfermline has lost the best part of £1 million in the last two seasons. Arbroath are a part-time football team. Cove Rangers are a part-time team and got relegated. Airdrieonians are half a million pounds in debt. Hamilton had a massive cash legacy from a youth set-up and squandered it on Nigerian Princes. And got relegated. All of these teams in the 2nd tier this year or last. Which of these teams do you suggest we emulate?